Hebron CT SAVE NOW

GO SOLAR

GO GREEN & FEEL THE LOVE

MAKING THE SWITCH to Solar is EASY IN Hebron CT

Why Go Love Solar?

Hebron CT Top Rated Solar Company

Love Solar USA is a trusted Hebron CT solar company that offers top-of-the-line solar panel installations. Our team of expert solar panel installers has years of experience in designing and installing solar systems that meet the specific needs of our clients. We understand the importance of making the switch to solar energy, which is why we offer the best solar incentives and tax credits in Hebron CT.

At Love Solar USA, we believe that renewable energy is the key to a sustainable future. That’s why we are committed to providing our clients with the most efficient and reliable solar systems on the market. We use only the highest quality materials and the latest technology to ensure that our solar panel installations are not only eco-friendly, but also cost-effective.

Our team of knowledgeable and friendly experts is always ready to answer any questions you may have about solar energy or our installation process. We take pride in our work and strive to exceed our clients’ expectations with every installation we complete. Contact us today to learn more about how Love Solar USA can help you make the switch to solar energy and save money on your energy bills!

OUR SERVICE AREA

We serve the following areas

Did you know that solar for homes in Hebron CT is more affordable and achievable than you might think? You can reduce your carbon footprint and increase your home’s value with residential solar. $0 down financing options, and rock-solid warranties.

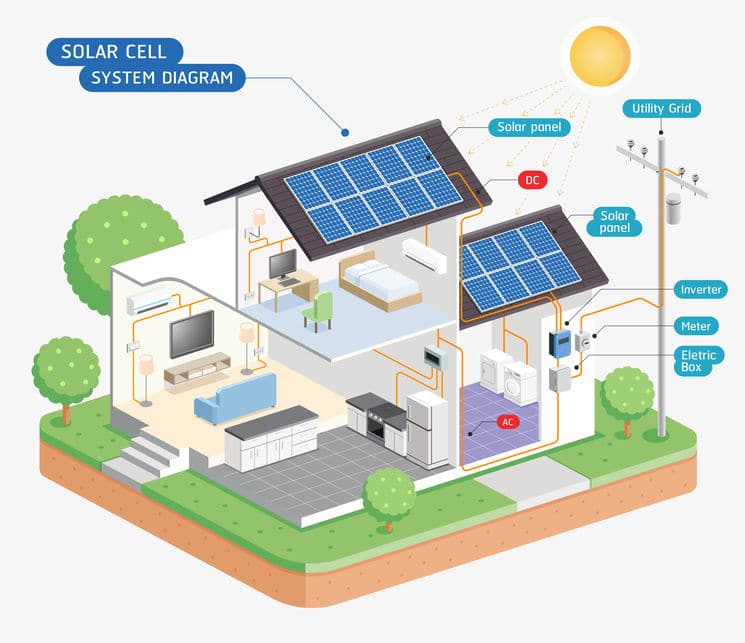

The smartest way to understand how solar works is by learning the basics of solar technology. To see a description of the individual parts see the diagram below. This will show you the Photovoltaic (PV) Panels, Inverters, AC Combiner Box and Main Service Panel and Utility Meter’s so you can decide if Solar is right for you in Hebron CT

Solar Company Hebron CT 06231. Coordinates: 41°39′N 72°23′W

Tolland County Connecticut

Hebron CT SOLAR 101

Did you know that the amount of sunlight that strikes the earth’s surface in an hour and a half is actually enough to handle the entire world’s energy consumption for a full year? Solar technologies convert sunlight into electrical energy either through photovoltaic (PV) panels or through mirrors that concentrate solar radiation. Then this energy can be used to generate electricity or even be stored in batteries and/or thermal storage.

Solar power generation starts when solar panels absorb sunlight with photovoltaic cells, generating direct current (DC) energy and then converting it to usable alternating current (AC) energy with the help of inverter technology. AC energy then flows through the home’s electrical panel and is distributed accordingly. Here are the main steps for how solar panels work for your home:

- Photovoltaic cells absorb the sun’s energy and convert it to DC electricity

- The solar inverter converts DC electricity from your solar modules to AC electricity, which is used by most home appliances

- Electricity flows through your home, powering electronic devices

- Excess electricity produced by solar panels is fed to the electric grid

The United States federal government subsidizes the purchase and installation of solar power generating systems with a general federal solar tax credit. This renewable energy tax credit is available to both residential homeowners and commercial businesses in Hebron CT. This tax credit also significantly reduces the payback time for solar power investments.

The Energy Policy Act of 2005 brought he solar investment tax credit to life. Originally this federal solar tax credit was originally only set to last until 2007, however the popularity of the program has led to extension for homeowners through 2022. Keep in mind, though it has been extended, the terms of the credit are not the same year to year.

So what is the solar investment tax credit for Hebron CT Residents?

So what is the solar investment tax credit for Hebron CT Residents?

- The federal solar investment investment tax credit (ITC) is a tax credit that can be claimed on federal income taxes for 26% of the cost of a solar photovoltaic (PV) system.

- The system must be placed in service during the tax year and generate electricity for a home located in the U.S.

- A solar energy PV system must be placed into service before December 31, 2021, to claim the credit in 2022 or December 31, 2022 to be claimed in 2023.

- There is no maximum amount that can be claimed.

Am I eligible to claim the solar investment tax credit in 2022?

You might be eligible for the solar investment tax credit if you meet all of the following criteria:

- The solar PV system is new or being used for the first time. The ITC can only be claimed on the “original

installation” of the solar equipment. - Your solar PV system was ‘placed in service’ between January 1, 2006, and December 31, 2021.

- You own the solar PV system ( e.g., you purchased it with cash or through financing)

- The solar PV system is located at a residential location in the U.S. (but not necessarily your primary residence).

So what is the solar investment tax credit for Hebron CT Residents?

So what is the solar investment tax credit for Hebron CT Residents?