GUIDE TO THE FEDERAL SOLAR TAX CREDIT

The United States federal government subsidizes the purchase and installation of solar power generating systems with a general federal solar tax credit. This renewable energy tax credit is available to both residential homeowners and commercial businesses. This tax credit also significantly reduces the payback time for solar power investments.

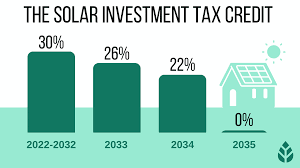

The Energy Policy Act of 2005 brought he solar investment tax credit to life. Originally this federal solar tax credit was originally only set to last until 2007, however the popularity of the program has led to extension for homeowners through 2032. Keep in mind, though it has been extended, the terms of the credit are not the same year to year.

So what is the solar investment tax credit?

So what is the solar investment tax credit?

- The federal solar investment investment tax credit (ITC) is a tax credit that can be claimed on federal income taxes for 30% of the cost of a solar photovoltaic (PV) system.

- The system must be placed in service during the tax year and generate electricity for a home located in the U.S.

- A solar energy PV system must be placed into service before December 31, 2021, to claim the credit in 2022 or December 31, 2022 to be claimed in 2023. Updated March 2023 this has been extended to 2032.

- There is no maximum amount that can be claimed.

Am I eligible to claim the solar investment tax credit in 2022?

You might be eligible for the solar investment tax credit if you meet all of the following criteria:

- The solar PV system is new or being used for the first time. The ITC can only be claimed on the “original

installation” of the solar equipment. - Your solar PV system was ‘placed in service’ between January 1, 2006, and December 31, 2021.

- You own the solar PV system ( e.g., you purchased it with cash or through financing)

- The solar PV system is located at a residential location in the U.S. (but not necessarily your primary residence).

What is the difference between a tax credit and a tax rebate?

It’s important to understand that this is a tax credit and not a rebate. You might be wondering what the difference is, well lucky for you we can explain:

Tax credit: a dollar-for-dollar reduction in the amount of income tax you would otherwise owe. For example, claiming a $1,000 federal tax credit reduces your federal income taxes due by $1,000.

- Tax credits offset the balance of tax due to the government (therefore, if you owe no tax, there is nothing to offset and you can’t take advantage of it).

Tax rebates: are payable to the taxpayer even if they owe no tax. Even though most people qualify for the solar panel tax credit, sadly there are some who do not. Anyone who does not owe federal income taxes will not be able to benefit from the solar tax credit. And, if you’re on a fixed income, retired, or only worked part of the year, you may not owe enough energy taxes to take full advantage of this solar tax credit.

Note: If you do owe sufficient federal taxes the year that you finance or purchase your system, then the credit can be applied to pay off the taxes owed. If you already paid that taxes by withholding it from your paycheck, the federal government will apply the tax credit to a tax refund. This refund can be used to pay down the balance on a loan. It’s important to note that the tax credit be carried forward one year, which means that you can use any remainder from this year as a credit towards next year’s taxes.

Solar Panel Tax Credit FAQ’s

WHAT IF THE SOLAR PANEL TAX CREDIT EXCEEDS MY TAX LIABILITY? WILL I GET A REFUND?

This is a nonrefundable tax credit, meaning you will not get a tax refund for the amount of the solar tax credit that exceeds your tax liability. However, you can carryover any unused amount of the solar tax credit to the next tax year.

CAN I USE THE SOLAR PANEL TAX CREDIT AGAINST THE ALTERNATIVE MINIMUM TAX?

Yes. The tax credit can be used against either the federal income tax or the alternative minimum tax credit.

HOW DO I CLAIM THE SOLAR TAX CREDIT?

File Tax Form 5695 with your tax return. That’s it!

(After seeking professional tax advice and ensuring you are eligible for the ITC.)

HOW MUCH LONGER IS THE SOLAR TAX CREDIT AVAILABLE?

Sadly, the amazing solar tax credit that caused such growth for the solar industry is on its proverbial last leg as 2022 is the last year to claim the 26% solar federal tax credit. The solar investment tax credit was extended once before in 2015, but that extra time is quickly running out. The table below details how much longer the tax credit is available for, and for how much.

So what is the solar investment tax credit?

So what is the solar investment tax credit?