UNDERSTAND YOUR SOLAR PANEL FINANCING OPTIONS

As electricity prices continue to rise from the traditional electricity grid, as well as unpredictable outages, solar for your home has become a need in order to future-proof your home’s energy.

Many financial options are available amongst companies that offer lower costs. Going solar will give you so much control over not only your home’s energy, but the savings to follow as well.

From added property value to decreased utility bills, solar is a smart financial investment as a home owner. To help homeowners with solar financing, Love Solar Energy Services will help walk you through a number of financing options. Whether you choose to do a solar lease, a solar loan, or direct purchase each method of solar panel financing comes with its advantages.

FINANCIAL OPTIONS:

Solar Loan

Solar Purchase

Solar Leases and PPA’S

SOLAR LOANS

Simply put a solar loan is a loan that is used towards the purchase of a solar power system for your home. The financing that comes with solar loans allows you to avoid the steep payments upfront while also giving you immediate ownership of your system. Just like with a regular loan, you will pay it off in monthly payments with an applied interest rate. Good news, you would be entitled to the benefits such as tax credits and rebates!

The benefits of buying your home solar system include greater long-term savings. This is especially true once your system pays for itself. Your future energy costs would be predictable, and already paid for. With federal incentives, local incentives and statewide rebate programs contributing toward your solar installation, owning your energy through solar is more affordable than ever.

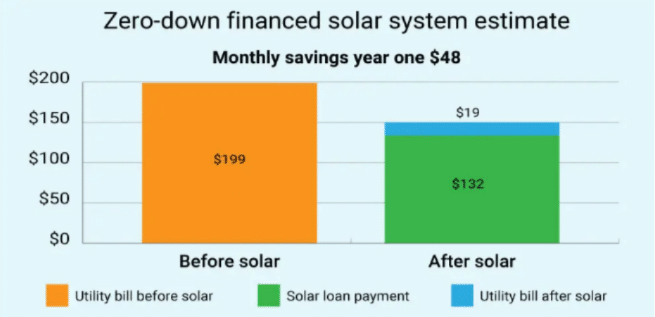

Solar loans can be cash flow positive from Month One, i.e. your monthly electric bill savings from the solar panels can more than cover monthly loan repayments.

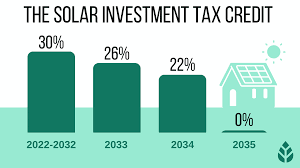

When you take out a solar loan, you qualify for the federal solar tax credit. This is worth 26% of total system costs – a substantial savings!

There are many zero-down solar loans available; some come with the provision that you use the tax credit to pay down the loan.

Breaking Down Solar Loan:

Solar panel loans have a similar structure to other loan types:

• The interest rate affects the total cost of the loan over its lifetime

• Shorter loan terms will have a higher monthly payment but a lower total cost

One aspect of a solar loan that is very different from other home improvement loans is the fact that you are financing an asset that can generate significate financial value. A solar system generates value through the electricity it produces as well as the solar incentives, tax credits, and rebates that you can redeem.

IS A SOLAR LOAN WORTH IT?

yes – you stand to save a lot of money by taking out a solar loan.

One important reason is that when you buy a solar panel system – whether through a solar loan or otherwise, you instantly increase the value of your home. A study by Zillow found solar panels add to property’s value.